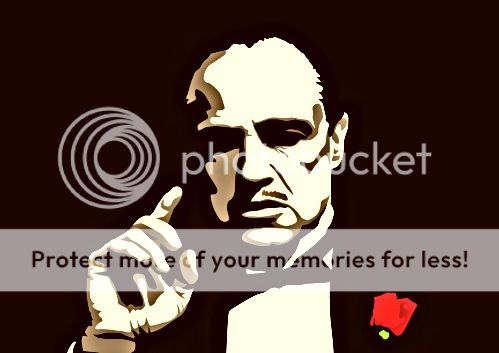

This week, the comparisons of Donald Trump to Hitler had to take a back seat to comparisons to Richard Nixon. But I would like to make a different comparison, one that I think has much to tell us about the unique threat that having Donald Trump in the White House poses to our nation. Allow me to present Donald Trump, mob boss.

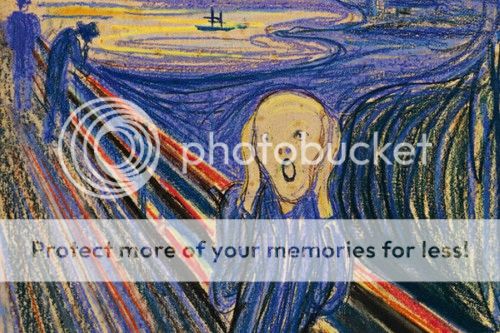

In fact, we know that Trump has had dealings with mob figures in the past. This was waived off during the campaign by some who pointed out that anyone who wanted to build something in New York City in the 1970s had to deal with the fact that the mob controlled the local concrete market. But Trump also had such figures as honored guests in his casinos, even enforcing their wishes not to be served by black employees on at least one documented occasion. More disturbing to me was a case that emerged during the campaign that resulted in statutory rape charges being brought and then dropped against Trump. The story goes that Trump attended a series of sex parties in the 1990s organized by Jeffrey Epstein. Epstein was convicted of similar activities, and is now a registered sex offender. Trump admitted to his friendship with Epstein in the 90s, but he was not a party to the charges that led to Epstein’s conviction. During the campaign, a “Jane Doe” emerged who said Trump raped her at these sex parties, and that he knew she was thirteen at the time. She had a witness, identified as “Tiffany”, who worked as a procurer of underage girls for these parties. The judge in last year’s case ruled that the charges could be brought even though the statute of limitations had expired, because he found credible the claim by Jane Doe that she had received death threats to her and her family, and it had taken her this long to feel safe. Jane Doe told a story, backed up by Tiffany, of a girl she called Maria, who was going to bring charges of her own back in the 90s until she disappeared one day.

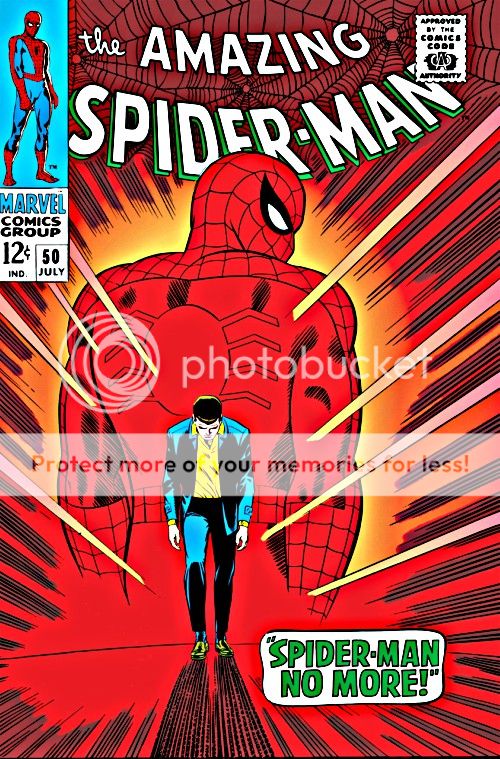

All of this must be regarded as hearsay. Jane Doe dropped her case abruptly last year, saying she was once again receiving death threats. So the case was never tried, and the evidence was never weighed in court. Around the same time, the fraud case against Trump University was settled out of court. We never learned the extent of Trump’s involvement in that one. This speaks to a perverse kind of privilege that Trump has known all his life. He is the son of a man who made his fortune in part by surrounding himself with cleaners, men who could make any story that could have damaged his reputation go away. Trump the son has always had his own cleaners as well, and now some of them are in the House and the Senate. Mitch McConnell, Devin Nunes, and Paul Ryan come to mind. It’s not hard to see that Trump hoped James Comey would become one of these cleaners as well. That would be why he tried to get Comey to swear loyalty to him at that dinner in January. If you grow up believing that the laws of this land only apply to those who don’t know how to make them go away, this would seem to be a natural role for the FBI, and it gives us an idea what qualities Trump will be looking for in a new FBI director.

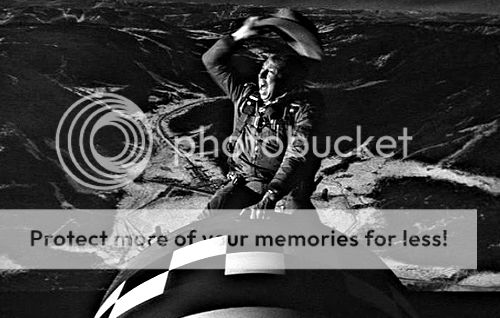

Cleaners know the job they have to do. Bad stories must be made to disappear, and no knowledge of how it was done must ever be traceable to the boss. The boss makes statements that, for example, the investigation into Russian meddling in the election is over, and the cleaners make it so by whatever means necessary. People who say, or worse insist, otherwise get silenced, and sometimes vanish. A phrase we learned during the Watergate case does apply here. The boss must at all times have plausible deniability. This week, we crossed a line in the chronicle of alleged misdeeds by Trump. First with the testimony of Sally Yates, and then with the events surrounding the firing of James Comey, we learned of attempts at damage control that occurred since Trump took office. If this turns out to be the first hints of an illegal cover up, this will matter because only illegal actions that occur while a president is in office are impeachable offenses. So Trump’s cleaners now have their hands full.

With so much of a protective shell around them, what can bring down men like Donald Trump? For Al Capone, it was income taxes. A more spectacular downfall can come from a stool pigeon. One guy sings, and suddenly the whole structure begins to collapse. That is what happened in the Watergate case. Our best hope now lies with the planned testimony of Michael Flynn. This also made it easy to pick this week’s song: