This week saw the release of the Trump budget plan. I was disappointed by the coverage of its likely outcomes in the media sources I go to for this kind of story. The budget assumes that the economy will grow at a rate of 3% as a result of the changes proposed. It is assumed that the extreme tax cuts in the American Health Care Act and the further tax cuts Trump wants Congress to afford in a separate bill that we do not have yet will bring about this growth, and that the increased tax revenues from this economic growth spurt will pay for the impact of the Trump budget on the deficit, that the deficit will in fact be reduced. Critics in my media sources have ranged from calling this “unlikely” to “overly optimistic”. It is nothing of the sort. Pardon my French, but this assumption is complete bullshit. I explained part of why in my last post. Tax cuts for the wealthy will go not into the economy, but rather into the financial markets. The rise in the markets that will result will not be sustainable without economic improvements to support it. But it’s much worse than that. To understand why, I would like you to meet John and Mary.

John and Mary are my creations. They are not real, in the sense that I am not talking about actual people I know. But I have named them John and Mary, not, say, Zeb and Lu-Ann, because I want you to take them seriously. John and Mary voted for Trump. They live in western Kentucky, because I wanted to put them in a deep red state that had approved Medicaid expansion. They both work, but they can only afford one used car between them, and hope nothing ever happens to it. So Mary works days at Walmart, while John works the night shift. During the week, they see each other during the time John drives Mary to work. Then John sleeps as much as he can while the kids are at school, and then gets up to be there for them when they get home. John and Mary have two boys. John and Mary work hard, but they rely of SNAP to have enough to feed their family. Mary sometimes has to work on Saturday, so Sunday is the only time the whole family can be together. They go to church in the morning, so only the afternoon is truly theirs. Mary gets human contact during the week from her customers, but for John, church provides a vital lifeline to the outside world. Most of the people they know are coal people. Their families and the families of almost everyone they know had someone who used to make a good living working in the mines. Hillary Clinton, they feel, never cared about those jobs, while Donald Trump spoke to the anger they felt over their loss.

Now we have the new budget proposal. John and Mary don’t have time to try to understand all of the details. They do know that it cuts SNAP, so they will have to make up the difference by doing without something else. They already know that they may need more money from somewhere to cover increased out-of-pocket expenses for their healthcare. Sure, they are basically healthy, so their premiums will go down. But they realize they will not only pay less; they will also get less coverage. But they have not considered the impact on people they know, and what that means to them. Everyone they know will have less money to spend, and will cut back wherever they can. This includes members of their congregation who have pre-existing conditions from the time they spent working in the mines. That means they will spend less at Walmart. John’s job also is in retail, so there will be reduced spending there is well. Although John and Mary have not thought about it, it is possible that one or both of them will be laid off because their employer needs less staff to handle the drop in sales.

So there you have it. 3% growth is not simply overly optimistic or unlikely. The budget cuts at least $1.5 trillion from consumer spending over ten years, and that will mean job losses for people like John and Mary. Those job losses in turn mean even further drops in consumer spending, causing more job losses, and so on. People in Congress, and certainly in the White House, have never lived in John and Mary’s world. They do not understand that the Johns and Marys of the world far outnumber them, and gain nothing from the tax cuts that provide more play money for Wall Street. Our lawmakers call that cut of $1.5 trillion “entitlement reform”, and they believe that the people who will suffer those cuts do not matter to the health of the economy. The budget basically says that John and Mary are expendable, and there are all kinds of rationalizations to explain how anyone who needs public assistance isn’t trying hard enough. John and Mary can’t try any harder. They have already had to sacrifice so much.

People like John and Mary used to reliably vote for Democrats. They or their families remembered the Great Depression, and how Roosevelt worked so hard to help the working man. They saw labor unions as a positive force in their lives, especially if you were a miner. But the Republicans seized on the corruption that afflicted unions to begin a campaign of vilifying organized labor. They also promoted a narrative that life was a fierce competition for finite resources, and that every dollar that went to someone with skin darker than yours came out of your pocket. Now they are positioned to blame the economic downturn that would result from the new budget on people who “just want handouts.” John and Mary don’t want handouts, but they will take whatever help they can find if it means their children are fed. It is long past time to find the Johns and Marys of the world, and make sure their stories are being told. For progressives, it could be the beginning of a new narrative, one that Roosevelt knew well, but has since been lost. More importantly, for John and Mary, it would let them know that they are not alone, and that the desperate circumstances they find themselves in are not their fault. The United States is still among the wealthiest nations on Earth. It is time John and Mary got to see some of that wealth in their own lives.

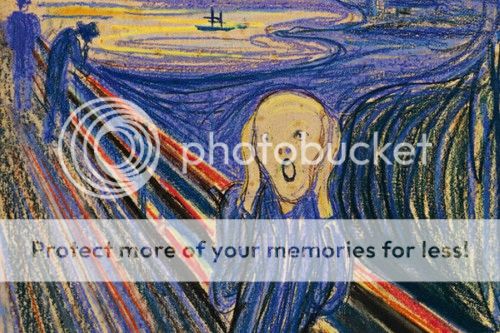

As it happens, I found this week’s song quite a while ago for my music video page on Facebook. But it certainly fits here as well: